What is Hyperliquid and Why Trade There?

Hyperliquid represents the next evolution of decentralized exchanges, offering institutional-grade trading infrastructure with the transparency and security of on-chain settlement. Unlike traditional DEXs, Hyperliquid provides:

- Lightning-fast execution with sub-second order matching

- Deep liquidity across major cryptocurrency pairs

- Advanced order types including stop-losses, take-profits, and conditional orders

- Competitive fees that rival centralized exchanges

- On-chain transparency with full audit trails

These features make Hyperliquid an ideal platform for both manual and automated trading strategies. However, to truly capitalize on Hyperliquid's capabilities, traders are increasingly turning to automated solutions.

Why You Need a Hyperliquid Trading Bot

The Speed Advantage

Cryptocurrency markets never sleep, and opportunities can emerge and disappear within seconds. A Hyperliquid bot operates 24/7, executing trades based on predetermined parameters without emotional interference or human delays. While manual traders might miss profitable setups during sleep or work hours, automated systems capture every opportunity.

Precision and Consistency

Human traders are susceptible to emotional d

Advanced Strategy Implementation

Complex trading strategies involving multiple indicators, timeframes, and conditional logic become manageable with automation. A sophisticated Hyperliquid API trading bot can simultaneously monitor dozens of assets, execute multi-leg strategies, and manage risk across an entire portfolio.

Risk Management Excellence

Automated systems excel at risk management, implementing stop-losses, position sizing rules, and portfolio rebalancing with perfect discipline. This systematic approach to risk management is crucial for long-term trading success.

The Hyperliquid Trading Bot Landscape

The market for Hyperliquid trading automation has evolved rapidly, with various solutions emerging to meet different trader needs. However, not all trading bots are created equal. The most effective solutions share several key characteristics:

Essential Features of Top Hyperliquid Bots

API Integration Excellence: The best Hyperliquid API trading bots provide seamless integration with Hyperliquid's native API, ensuring reliable order execution and real-time data access. Multiple Integration Options: Leading platforms support various input methods, from webhook integrations to direct API calls, accommodating different trading workflows. Advanced Order Types: Support for Hyperliquid's full range of order types, including market orders, limit orders, stop-losses, and take-profits. Real-time Monitoring: Comprehensive dashboards and monitoring tools that provide visibility into bot performance and portfolio status. Risk Management Tools: Built-in safeguards including position limits, drawdown controls, and emergency stop mechanisms.

Katoshi: The Ultimate Hyperliquid Trading Bot Platform

Among the various solutions available, Katoshi has established itself as the premier platform for Hyperliquid trading automation. Here's what sets Katoshi apart:

Unmatched API Integration

Katoshi's Signal API represents the gold standard for Hyperliquid API trading bot functionality. With comprehensive coverage of both perpetual and spot markets, the platform supports:

- Universal Actions: Market orders, limit orders, scale orders, and order management across all asset types

- Perpetual-Specific Features: Position management, leverage control, and advanced risk management tools

- Spot Trading Support: Complete spot market functionality with specialized order types

Revolutionary AI Agent Technology

Katoshi's proprietary AI agents represent the cutting edge of trading automation. These intelligent systems can:

- Interpret Natural Language: Execute complex trading strategies using simple English commands

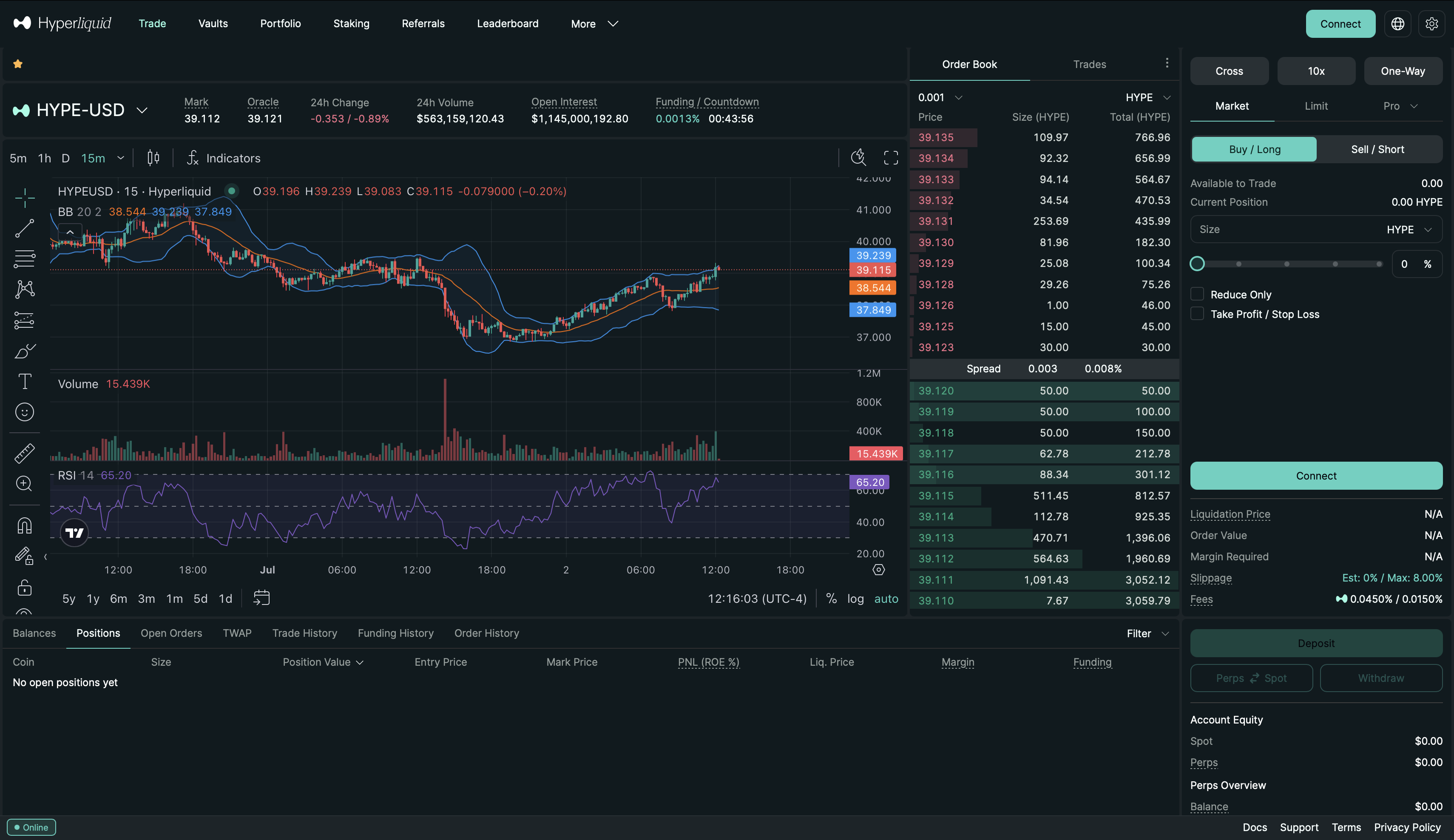

- Perform Technical Analysis: Analyze charts using RSI, MACD, Bollinger Bands, EMA, ATR, OBV, and VWAP

- Make Contextual Decisions: Combine multiple data sources to make informed trading decisions

- Adapt to Market Conditions: Adjust strategies based on real-time market analysis

Seamless TradingView Integration

For traders using TradingView for analysis, Katoshi provides the most sophisticated Hyperliquid TradingView integration available. This integration enables:

- Webhook Automation: Direct signal transmission from TradingView alerts to Hyperliquid positions

- Strategy Monetization: Publish successful strategies to Katoshi's marketplace

- Multi-Asset Support: Execute strategies across Hyperliquid's entire asset universe

- Real-time Execution: Minimal latency between signal generation and order execution

Advanced Risk Management

Katoshi's risk management capabilities exceed industry standards:

- Flexible Position Sizing: Support for contract-based, USD-based, and percentage-based position sizing

- Intelligent Stop-Losses: Both percentage-based and price-based stop-loss mechanisms

- Take-Profit Optimization: Multiple take-profit strategies to maximize returns

- Slippage Protection: Built-in safeguards against adverse market movements

- Leverage Controls: Intelligent leverage management to optimize capital efficiency

Developer-Friendly Architecture

Katoshi's platform is built with developers in mind:

- Comprehensive API Documentation: Detailed guides and examples for all API endpoints

- MCP Integration: Model Context Protocol support for AI platform integration

- Webhook Support: Flexible webhook systems for external integrations

- Testing Tools: Built-in terminal and debugging tools for strategy development

Getting Started with Katoshi

Setting Up Your First Hyperliquid Bot

Account Creation: Sign up for a Katoshi account and obtain your API key Hyperliquid Connection: Link your Hyperliquid account securely through Katoshi's interface Bot Configuration: Create your first bot with customized parameters and risk settings Strategy Implementation: Deploy your trading strategy using Katoshi's intuitive interface Monitoring and Optimization: Use Katoshi's analytics tools to track performance and refine your approach

Best Practices for Hyperliquid Trading Bots

Start Small: Begin with conservative position sizes while you learn the platform and refine your strategies. Diversify Strategies: Don't rely on a single trading approach. Implement multiple strategies across different timeframes and assets. Monitor Performance: Regularly review bot performance and adjust parameters based on market conditions. Risk Management First: Always prioritize capital preservation over aggressive profit-seeking. Stay Informed: Keep up with Hyperliquid updates and platform changes that might affect your strategies.

Advanced Strategies with Katoshi

Multi-Asset Portfolio Management

Katoshi's platform enables sophisticated portfolio management across Hyperliquid's entire asset universe. Advanced users can:

- Implement pairs trading strategies

- Execute cross-asset arbitrage opportunities

- Manage correlation-based position sizing

- Automate portfolio rebalancing

AI-Powered Market Making

Using Katoshi's AI agents, traders can implement intelligent market-making strategies that:

- Adjust spreads based on volatility

- Manage inventory risk dynamically

- Optimize for changing market conditions

- Integrate multiple data sources for decision-making

Event-Driven Trading

Katoshi's webhook integration enables event-driven trading strategies that respond to:

- News and social media sentiment

- On-chain data signals

- Technical indicator combinations

- Market structure changes

The Future of Hyperliquid Trading Automation

As Hyperliquid continues to grow and evolve, the role of automated trading will only become more critical. Several trends are shaping the future of Hyperliquid trading bots:

AI Integration

The integration of artificial intelligence into trading systems is accelerating. Katoshi's AI agents represent the vanguard of this trend, demonstrating how natural language processing and machine learning can enhance trading automation.

Cross-Platform Integration

Future trading systems will seamlessly integrate across multiple platforms and data sources. Katoshi's MCP integration and comprehensive API support position it at the forefront of this cross-platform future.

Regulatory Compliance

As the DeFi space matures, compliance and transparency will become increasingly important. Platforms that prioritize security and compliance will have significant advantages.

Community-Driven Development

The most successful platforms will be those that foster strong developer communities and enable strategy sharing and monetization.

Why Katoshi Leads the Hyperliquid Trading Bot Market

Katoshi's dominance in the Hyperliquid bot space stems from several key advantages:

Technical Excellence

Katoshi's infrastructure is built for scale and reliability. The platform's robust API, comprehensive feature set, and intelligent architecture provide the foundation for successful automated trading.

Innovation Leadership

From AI agents to MCP integration, Katoshi consistently introduces cutting-edge features that push the boundaries of what's possible in trading automation.

User-Centric Design

The platform balances powerful functionality with intuitive usability, making advanced trading automation accessible to traders of all skill levels.

Community and Support

Katoshi's active community and responsive support team ensure users have the resources they need to succeed.

Proven Track Record

With a growing user base and documented success stories, Katoshi has established itself as the trusted choice for serious Hyperliquid traders.

Conclusion: The Katoshi Advantage

The Hyperliquid trading bot market is rapidly evolving, but Katoshi has established a commanding lead through technical innovation, user-focused design, and unwavering commitment to trader success. Whether you're a beginner looking to automate simple strategies or an advanced trader implementing sophisticated AI-powered systems, Katoshi provides the tools and infrastructure you need to succeed.

The combination of comprehensive API integration, revolutionary AI agents, seamless Hyperliquid TradingView integration, and industry-leading risk management makes Katoshi the clear choice for traders serious about Hyperliquid automation.

As Hyperliquid continues to grow and new opportunities emerge, having the right trading automation platform becomes increasingly critical. Don't let manual trading limitations hold you back from capitalizing on Hyperliquid's potential. Join the growing community of successful traders who have chosen Katoshi as their Hyperliquid API trading bot solution.

Ready to transform your Hyperliquid trading experience? Get started with Katoshi today and discover why we're the #1 choice for Hyperliquid trading automation.

Katoshi is the automated trading layer for Hyperliquid, providing smart traders with the tools they need to succeed in the evolving DeFi landscape. Our platform combines cutting-edge technology with user-friendly design to deliver the ultimate trading automation experience.